With CitizensBank24, you have instant access to your accounts wherever you go.

Smartphone users can enjoy the convenience of our iPhone and Android apps, and customers with a web-enabled phone can access the interface with their browser. And, as always, you’re protected by cutting-edge security technology when you bank with Citizens.

With CitizensBank24 you can:

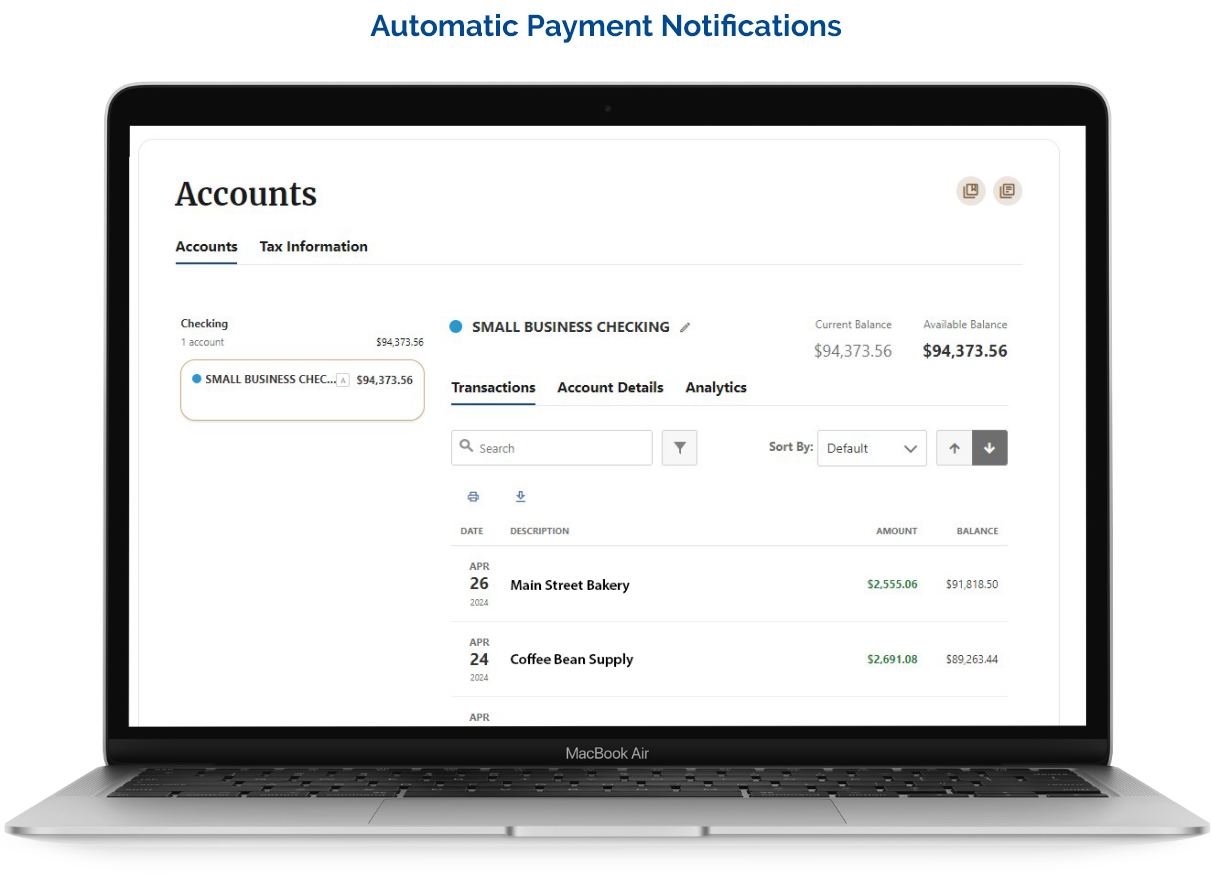

- Check account balances

- See recent transactions

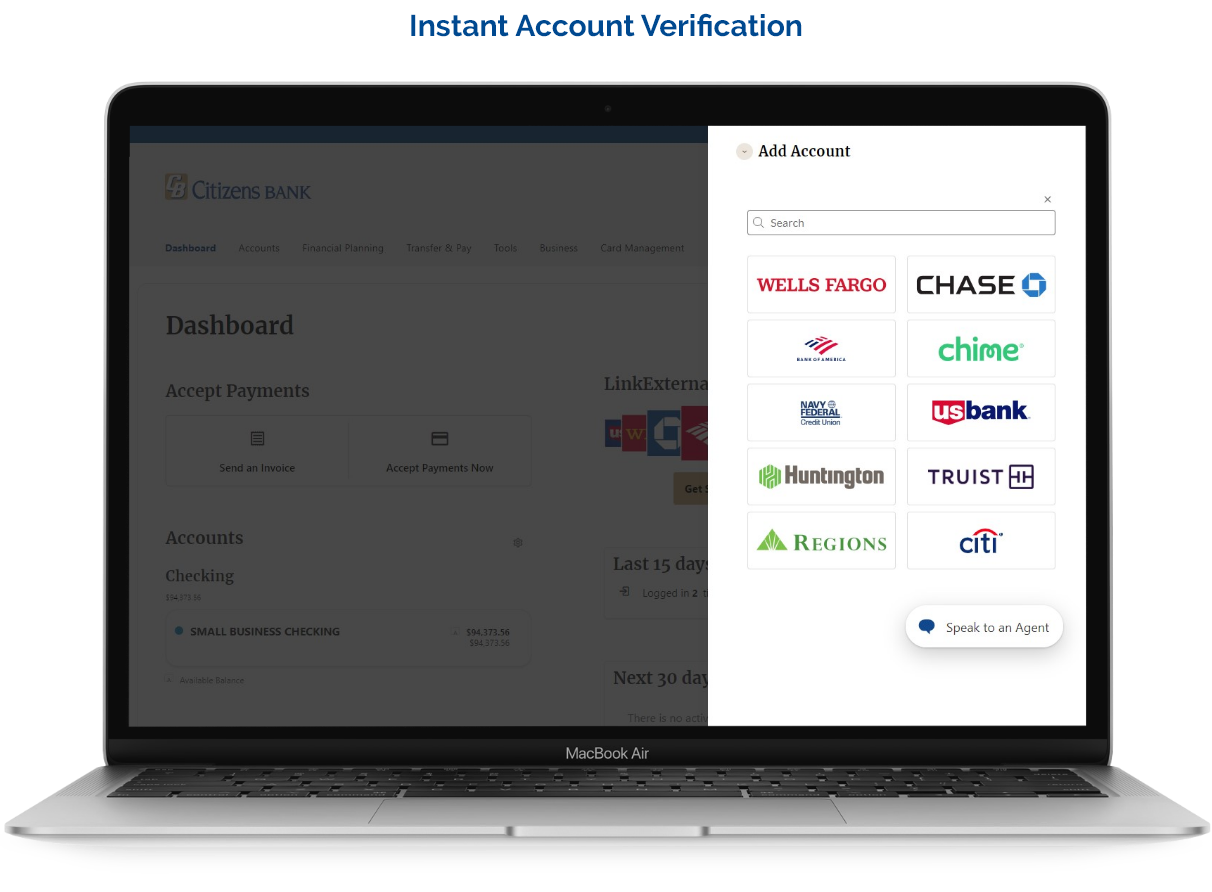

- Transfer money between accounts

- Electronic Bill Pay

- Pay bills

- Set up new vendors

- Make deposits with EZ Deposit Mobile* (Apple and Android apps only)

- Find your nearest Citizens Bank ATM or branch (Apple and Android apps only)

- Manage your Debit Mastercard(s)®.

- Turn your debit card on and off

- Set spending limits based on dollar amount, transaction type, merchant type

- Set specific regions where the card can and can’t be used

- Set parental controls and monitoring

- Get instant alerts on specific types of transactions

Click here for important information regarding Debit Card Protection.

To report a lost or stolen card, increase daily debit card limit, or report travel plans, call (866) 882-2265.

How to download the app:

Search for CitizensBank24 in Google Play or your Apple App Store, or you can download the latest and most convenient version for Apple or Android devices here***.

* Deposit limits and other restrictions may apply.

** Most smartphones and web-enabled mobile phones can be used with our mobile banking service. Mobile banking use is subject to the terms and conditions of the Citizens Bank Online Banking Agreement and Mobile Banking Agreement.

*** Your wireless service provider may charge additional fees for data usage and text messaging. Consult your wireless provider for details.